Understanding and mastering ratios in Excel is crucial for data analysis and financial modeling. Ratios provide valuable insights into the performance and health of a business, allowing stakeholders to make informed decisions. In this comprehensive tutorial, we will explore 15 essential ratios that every Excel user should know. From calculating profitability to assessing liquidity, we'll cover a wide range of ratios and provide step-by-step instructions for their computation.

Profitability Ratios

Profitability ratios measure a company's ability to generate profits and revenue. These ratios are essential for evaluating the financial health and performance of a business.

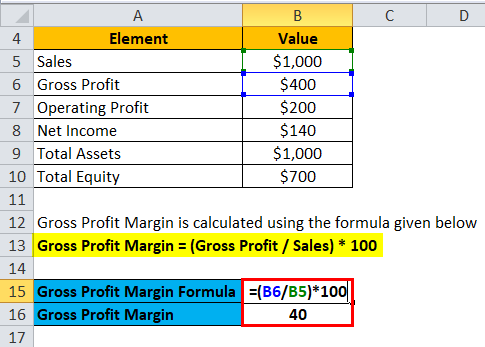

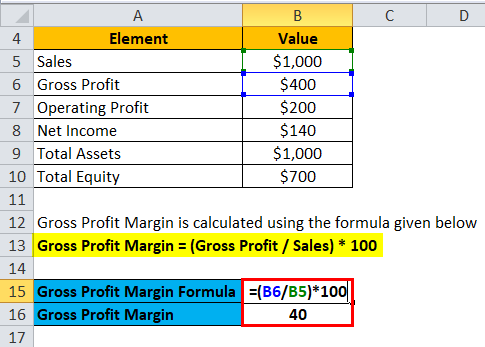

Gross Profit Margin

The gross profit margin ratio calculates the percentage of revenue remaining after deducting the cost of goods sold (COGS). It indicates the efficiency of a company's production and pricing strategies.

- Formula: (Revenue - COGS) / Revenue

- Interpretation: A higher gross profit margin suggests better control over production costs and higher profitability.

Net Profit Margin

The net profit margin ratio assesses the overall profitability of a company by considering all expenses. It represents the percentage of revenue left after all costs have been deducted.

- Formula: (Net Income / Revenue) * 100

- Interpretation: A higher net profit margin indicates better financial performance and a stronger ability to generate profits.

Return on Assets (ROA)

ROA measures a company's efficiency in generating profits from its assets. It helps evaluate how effectively a company utilizes its assets to generate returns.

- Formula: (Net Income / Average Total Assets) * 100

- Interpretation: A higher ROA indicates better asset utilization and financial performance.

Liquidity Ratios

Liquidity ratios assess a company's ability to meet short-term obligations and manage its cash flow. These ratios are crucial for understanding a company's financial stability and solvency.

Current Ratio

The current ratio compares a company's current assets to its current liabilities. It indicates the company's ability to pay off short-term debts with its current assets.

- Formula: Current Assets / Current Liabilities

- Interpretation: A current ratio of 1 or higher is generally considered healthy, indicating sufficient liquidity to cover short-term obligations.

Quick Ratio (Acid-Test Ratio)

The quick ratio, also known as the acid-test ratio, is a more stringent measure of liquidity. It excludes inventory from current assets, focusing on the most liquid assets.

- Formula: (Current Assets - Inventory) / Current Liabilities

- Interpretation: A quick ratio of 1 or higher is desirable, suggesting the company can meet its short-term obligations without relying on selling inventory.

Cash Ratio

The cash ratio is the most conservative liquidity measure, considering only the most liquid assets - cash and cash equivalents.

- Formula: (Cash and Cash Equivalents / Current Liabilities

- Interpretation: A cash ratio of 0.5 or higher is generally considered satisfactory, indicating the company has sufficient cash to cover its immediate obligations.

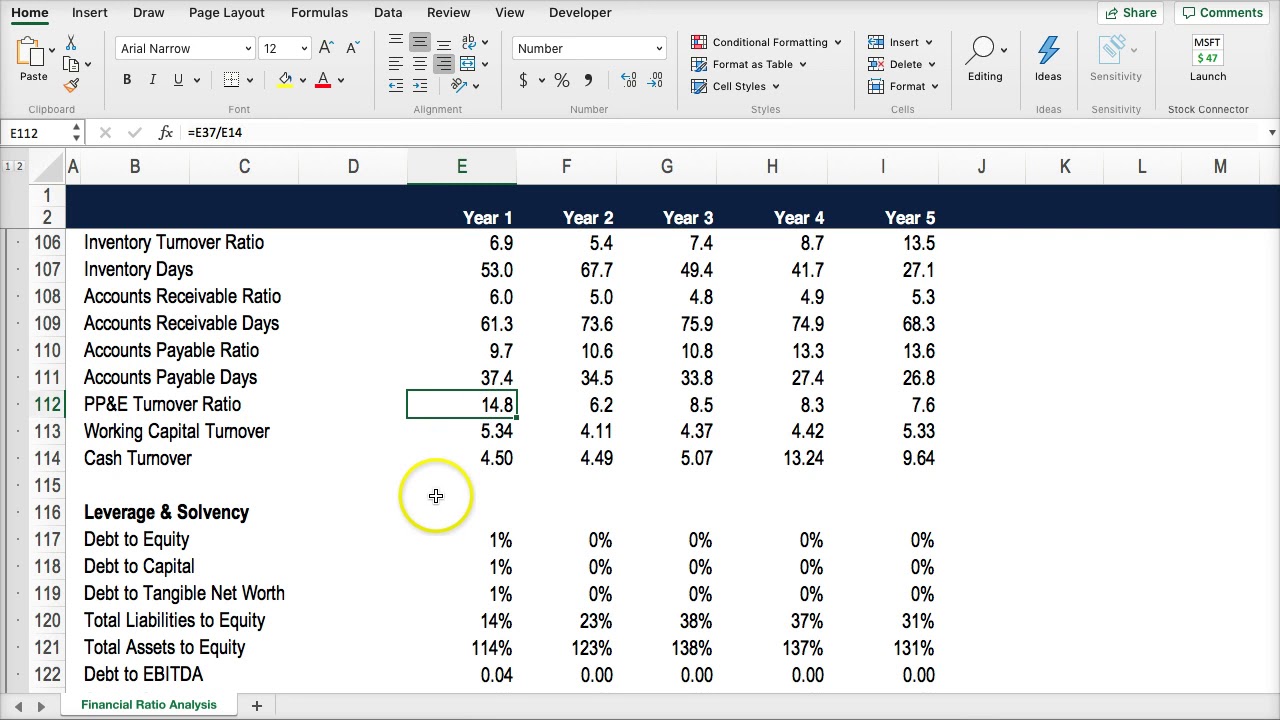

Solvency Ratios

Solvency ratios evaluate a company's long-term financial health and its ability to meet long-term obligations. These ratios provide insights into a company's financial stability and its capacity to repay debts.

Debt-to-Equity Ratio

The debt-to-equity ratio compares a company's total liabilities to its shareholders' equity. It indicates the proportion of financing derived from debt versus equity.

- Formula: Total Liabilities / Shareholders' Equity

- Interpretation: A lower debt-to-equity ratio suggests a more stable financial position, as the company relies less on debt financing.

Interest Coverage Ratio

The interest coverage ratio assesses a company's ability to generate enough profit to cover its interest expenses. It is a measure of financial risk and stability.

- Formula: EBIT / Interest Expense

- Interpretation: A higher interest coverage ratio indicates a stronger financial position, as the company can comfortably cover its interest obligations.

Times Interest Earned Ratio

The times interest earned ratio, also known as the interest coverage ratio, is another measure of a company's ability to meet its interest expenses.

- Formula: EBIT / Interest Expense

- Interpretation: Similar to the interest coverage ratio, a higher times interest earned ratio suggests a better financial position.

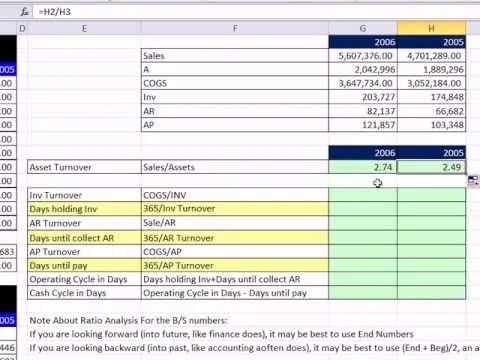

Activity Ratios

Activity ratios, also known as efficiency ratios, evaluate how effectively a company utilizes its resources and manages its operations.

Inventory Turnover Ratio

The inventory turnover ratio measures how quickly a company sells its inventory. It indicates the efficiency of inventory management.

- Formula: Cost of Goods Sold / Average Inventory

- Interpretation: A higher inventory turnover ratio suggests better inventory management and faster sales.

Days Sales Outstanding (DSO)

DSO calculates the average number of days it takes for a company to collect payment from its customers. It assesses the efficiency of the company's credit policies.

- Formula: (Average Accounts Receivable / Credit Sales) * 365

- Interpretation: A lower DSO indicates better credit policies and faster collection of payments.

Asset Turnover Ratio

The asset turnover ratio measures how efficiently a company utilizes its assets to generate sales. It provides insights into the effectiveness of asset management.

- Formula: Revenue / Average Total Assets

- Interpretation: A higher asset turnover ratio suggests better asset utilization and higher sales efficiency.

Market Value Ratios

Market value ratios analyze a company's stock performance and its relationship with its financial health. These ratios are crucial for investors and shareholders.

Price-to-Earnings Ratio (P/E Ratio)

The P/E ratio compares a company's stock price to its earnings per share. It helps evaluate whether a stock is overvalued or undervalued.

- Formula: Stock Price / Earnings Per Share (EPS)

- Interpretation: A higher P/E ratio suggests that investors expect higher future earnings, while a lower ratio may indicate an undervalued stock.

Price-to-Book Ratio (P/B Ratio)

The P/B ratio compares a company's market value to its book value. It assesses whether a stock is reasonably priced based on its assets and liabilities.

- Formula: Market Value Per Share / Book Value Per Share

- Interpretation: A P/B ratio of 1 or lower may indicate an undervalued stock, while a higher ratio suggests overvaluation.

Dividend Yield

Dividend yield measures the return on investment for shareholders in the form of dividends. It is a crucial ratio for income-focused investors.

- Formula: Annual Dividends Per Share / Stock Price

- Interpretation: A higher dividend yield indicates a higher return on investment through dividends.

Additional Ratios

Return on Equity (ROE)

ROE measures a company's profitability relative to its shareholders' equity. It assesses how effectively a company generates profits for its owners.

- Formula: (Net Income / Average Shareholders' Equity) * 100

- Interpretation: A higher ROE indicates better financial performance and a more efficient use of shareholders' capital.

Operating Profit Margin

The operating profit margin ratio focuses on a company's operating efficiency by considering only operating expenses. It excludes interest and tax expenses.

- Formula: (Operating Income / Revenue) * 100

- Interpretation: A higher operating profit margin suggests better control over operating costs and improved profitability.

Debt Ratio

The debt ratio measures the proportion of a company's assets that are financed by debt. It provides insights into a company's financial leverage.

- Formula: Total Liabilities / Total Assets

- Interpretation: A lower debt ratio indicates a more conservative financial position, with a lower reliance on debt financing.

Conclusion

Understanding and calculating these 15 ratios in Excel is essential for financial analysis and decision-making. Each ratio provides unique insights into different aspects of a company's financial health and performance. By mastering these ratios, you can make informed judgments about a company's profitability, liquidity, solvency, and overall financial stability. Remember to consider multiple ratios and their trends over time for a comprehensive analysis.

FAQ

What is the purpose of calculating ratios in Excel?

+Calculating ratios in Excel helps analyze and compare financial data, providing insights into a company’s performance, stability, and efficiency.

How can I improve the accuracy of my ratio calculations in Excel?

+Ensure you have accurate and up-to-date financial data, double-check formulas, and consider using Excel’s built-in functions for complex calculations.

Are there any common mistakes to avoid when calculating ratios in Excel?

+Common mistakes include using incorrect data, overlooking formula errors, and failing to consider the specific requirements of each ratio.

How can I interpret the results of ratio calculations in Excel?

+Interpretation depends on the specific ratio and industry norms. Compare results with industry averages, analyze trends, and consider multiple ratios for a comprehensive understanding.