Unraveling the Mystery: 17 Methods to Compute the Sharpe Ratio in Excel

Excel, a ubiquitous tool in the financial world, offers a plethora of ways to calculate the Sharpe Ratio, a critical metric for evaluating investment performance. This guide explores 17 diverse methods, each with its unique approach, ensuring you find the most suitable one for your needs.

Method 1: Manual Calculation

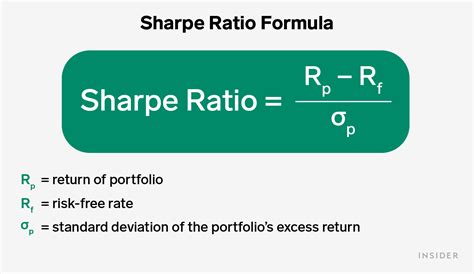

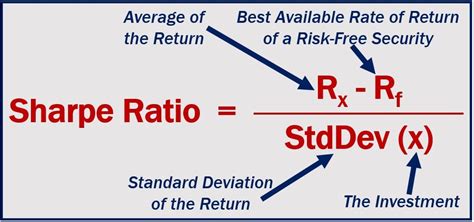

Begin by calculating the excess return of your investment over the risk-free rate. This can be done by subtracting the risk-free rate from the investment return. Next, calculate the standard deviation of these excess returns. Finally, divide the average excess return by the standard deviation to obtain the Sharpe Ratio.

Formula: Sharpe Ratio = (Average Excess Return) / (Standard Deviation of Excess Returns)

Method 2: Using the AVERAGE and STDEV Functions

Excel's built-in functions make calculations a breeze. To find the average excess return, use the AVERAGE function. For standard deviation, employ the STDEV function. Remember, these functions require a range of cells containing your data.

Method 3: The VAR Function

Excel's VAR function calculates variance, which can be squared to get the standard deviation. This method is similar to using the STDEV function but provides an alternative approach.

Method 4: Utilizing the AVERAGEIF Function

When dealing with a large dataset, the AVERAGEIF function can be a lifesaver. It allows you to calculate the average excess return based on a specific condition, such as a date range or a particular investment type.

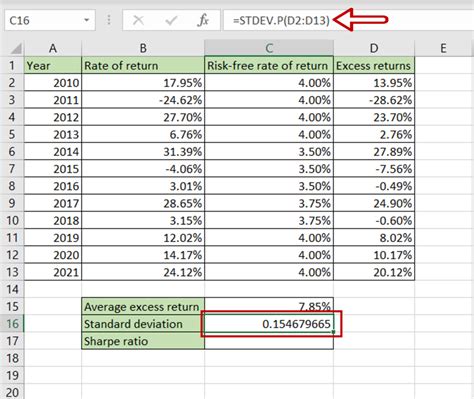

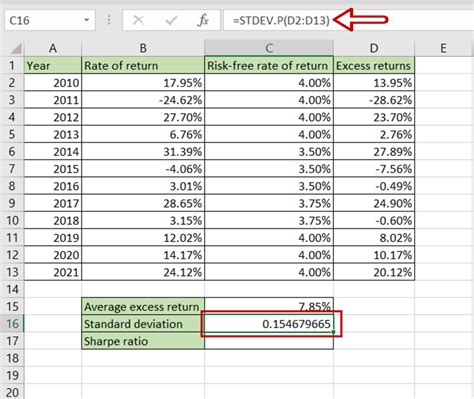

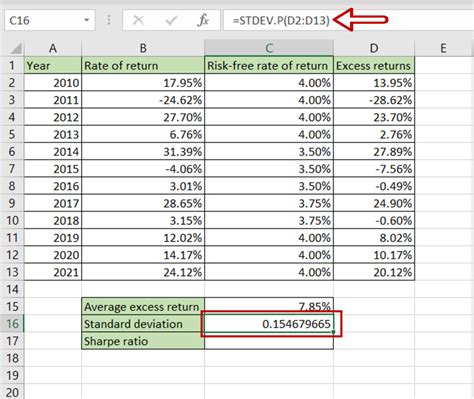

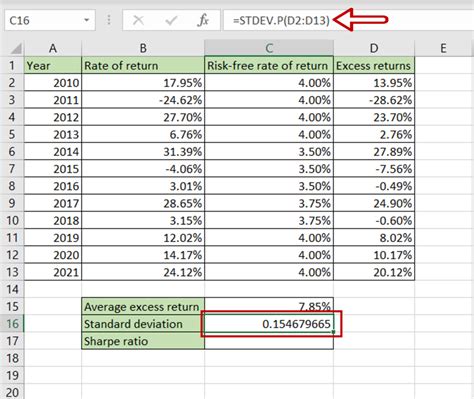

Method 5: AVERAGE and STDEVP Functions

For a more comprehensive calculation, use the STDEVP function, which considers the entire population of data. Pair it with the AVERAGE function to get an accurate Sharpe Ratio.

Method 6: Excel's SUMPRODUCT Function

The SUMPRODUCT function multiplies corresponding components in the given arrays and returns the sum of those products. It can be used to calculate the average excess return by multiplying excess returns with their corresponding weights.

Method 7: Using the AVERAGEA Function

The AVERAGEA function is similar to AVERAGE but includes non-numeric values as zero in the calculation. This can be useful when dealing with datasets containing text or blank cells.

Method 8: The MEDIAN Function

Sometimes, the median excess return might be a better representation than the average. Excel's MEDIAN function can help calculate the median excess return, which can then be used in the Sharpe Ratio formula.

Method 9: MODE.SNGL Function

The MODE.SNGL function returns the most frequently occurring value in a dataset. This function can be used to find the mode excess return, which can be useful in certain investment strategies.

Method 10: The CORREL Function

The CORREL function calculates the correlation coefficient between two sets of data. While not directly related to the Sharpe Ratio, it can be used to assess the relationship between investment returns and a benchmark.

Method 11: Using the COVAR Function

Similar to the CORREL function, the COVAR function calculates covariance, which measures the joint variability of two sets of data. It can provide insights into the relationship between investment returns and a benchmark.

Method 12: The TREND Function

The TREND function is used to calculate a linear trend line for known x- and y-values. It can be employed to forecast future excess returns, which can then be used in the Sharpe Ratio calculation.

Method 13: FORECAST Function

The FORECAST function predicts a future value based on existing values provided. Like the TREND function, it can be used to forecast excess returns for the Sharpe Ratio.

Method 14: Excel's SLOPE Function

The SLOPE function calculates the slope of a linear regression line. It can be used to determine the slope of the line of best fit for excess returns, which can be useful in certain investment strategies.

Method 15: INTERCEPT Function

The INTERCEPT function calculates the y-intercept of a linear regression line. Combined with the SLOPE function, it can provide a comprehensive view of the relationship between excess returns and a benchmark.

Method 16: Excel's RSQ Function

The RSQ function returns the square of the Pearson product-moment correlation coefficient, also known as the coefficient of determination. It can be used to assess the goodness of fit of a linear regression line for excess returns.

Method 17: STEYX Function

The STEYX function calculates the standard error of the estimated y-values in a linear regression. It can be employed to assess the accuracy of the linear regression model for excess returns.

Notes

📝 Note: Remember to adjust your calculations based on the frequency of your data. For example, if your data is monthly, you might need to annualize your Sharpe Ratio. Additionally, ensure your risk-free rate is appropriate for your investment horizon.

📝 Note: Consider the type of investment and its associated risks when interpreting your Sharpe Ratio. A higher ratio might not always be better, especially if the investment is extremely volatile.

Conclusion

The Sharpe Ratio is a powerful tool for investment analysis, and Excel offers a wide range of functions to calculate it. By understanding these methods, you can choose the most appropriate one for your specific needs and gain valuable insights into your investment performance. Remember, the right approach depends on your data and investment strategy, so choose wisely and analyze effectively.

FAQ

What is the Sharpe Ratio, and why is it important for investment analysis?

+

The Sharpe Ratio is a measure of risk-adjusted return, helping investors compare the performance of different investments. It’s important because it takes into account both the return and the risk of an investment, providing a more comprehensive view of its attractiveness.

How do I annualize my Sharpe Ratio if my data is not annual?

+

To annualize your Sharpe Ratio, you need to adjust the standard deviation and average excess return based on the frequency of your data. For example, if your data is monthly, you would multiply the standard deviation by the square root of 12 and the average excess return by 12.

What is a good Sharpe Ratio, and how can I interpret it?

+

A good Sharpe Ratio is typically considered to be above 1. However, the interpretation depends on the investment type and its associated risks. A higher Sharpe Ratio indicates better risk-adjusted returns, but it’s important to consider the volatility and other factors of the investment.

Can I use the Sharpe Ratio for all types of investments?

+

The Sharpe Ratio is most commonly used for traditional investments like stocks, bonds, and mutual funds. While it can be applied to other investments, its effectiveness might vary. It’s important to consider the specific characteristics and risks of the investment when interpreting the Sharpe Ratio.

Are there any limitations to the Sharpe Ratio as an investment metric?

+

Yes, the Sharpe Ratio has certain limitations. It assumes a normal distribution of returns and a constant risk-free rate, which might not always hold true. Additionally, it only considers volatility as risk, ignoring other factors like liquidity and market impact. It’s important to use the Sharpe Ratio in conjunction with other investment metrics for a comprehensive analysis.