Introduction: Unlocking Your Peace of Mind with Great Western Insurance

The world of insurance can be a complex maze, but with the right guidance, you can navigate it effortlessly and secure a plan tailored to your needs. In this comprehensive guide, we’ll explore five strategic steps to help you create your ultimate Great Western Insurance plan, ensuring you’re well-protected for the future. Whether you’re a business owner or an individual seeking comprehensive coverage, these steps will empower you to make informed decisions and take control of your insurance journey. So, let’s dive in and unlock the secrets to a secure and worry-free future!

Step 1: Understanding Your Insurance Needs

Assessing Your Risks: The first step towards crafting your Great Western Insurance plan is understanding the risks you face. Take a moment to assess your personal or business situation and identify the potential hazards that could impact your financial stability. This could include natural disasters, accidents, theft, or even legal liabilities. By identifying these risks, you can better understand the type and extent of coverage you require.

Evaluating Current Coverage: Before you begin, it’s essential to evaluate any existing insurance policies you may have. Review your current plans to identify any gaps or areas where your coverage might be insufficient. This step will help you avoid duplicating coverage and ensure you’re not paying for unnecessary policies. It’s all about maximizing the value of your insurance investment.

Step 2: Exploring Great Western’s Product Range

A Diverse Portfolio: Great Western Insurance offers a wide array of products to cater to various needs. From property and casualty insurance to life and health coverage, their portfolio is extensive. Take the time to explore their website or speak to a representative to gain a comprehensive understanding of the options available to you. This step is crucial in matching your specific requirements with the right insurance solutions.

Customized Solutions: Great Western Insurance prides itself on providing customized solutions. Whether you’re a small business owner looking for comprehensive business insurance or an individual seeking tailored health coverage, they can adapt their plans to fit your unique circumstances. By understanding their customization capabilities, you can ensure your insurance plan is perfectly suited to your needs.

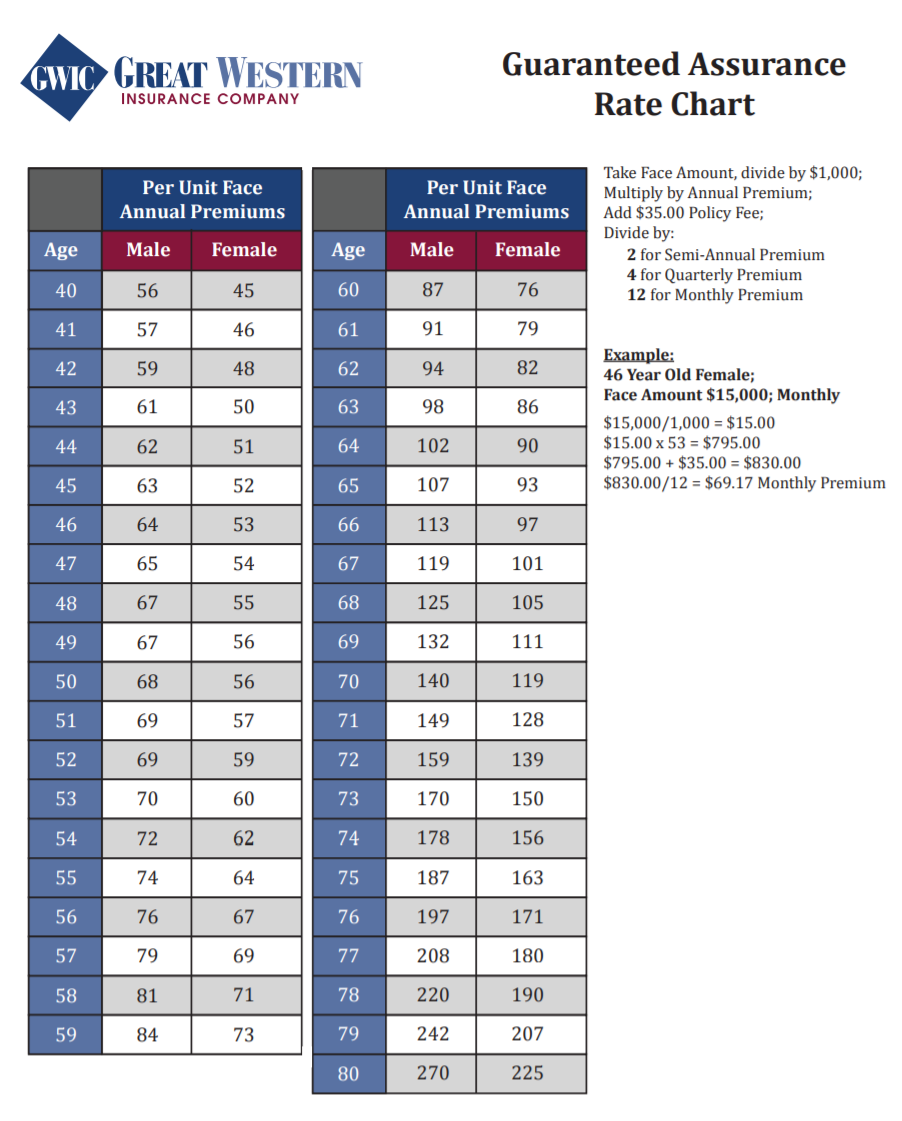

Step 3: Comparing Quotes and Benefits

Obtaining Multiple Quotes: To make an informed decision, it’s essential to compare quotes from different insurance providers. Request quotes from Great Western Insurance and other reputable companies to understand the range of prices and benefits on offer. This step will help you identify the most cost-effective plan while ensuring you receive the coverage you require.

Analyzing Benefits: Beyond the price, it’s crucial to delve into the benefits and features of each plan. Compare the coverage limits, deductibles, and any additional perks or discounts offered. Look for plans that provide comprehensive coverage without unnecessary add-ons that could drive up the cost. This analysis will ensure you’re getting the best value for your money.

Step 4: Customizing Your Great Western Plan

Tailoring to Your Needs: Now that you have a solid understanding of Great Western’s offerings and have compared quotes, it’s time to customize your plan. Work closely with a Great Western representative to select the coverage options that align with your identified risks and requirements. This step is where your plan truly becomes ‘yours,’ as it’s tailored to your unique situation.

Adding Personalized Touches: Great Western Insurance allows you to add personalized touches to your plan. Whether it’s adjusting coverage limits, opting for specific add-ons, or including unique coverage for specific risks, this step ensures your plan is perfectly suited to your needs. Don’t be afraid to ask questions and seek clarification to ensure you fully understand the nuances of your customized plan.

Step 5: Finalizing and Managing Your Plan

Review and Sign: Once you’ve customized your Great Western Insurance plan, it’s time to review the final details and sign the necessary documentation. Take the time to carefully read through the policy to ensure it aligns with your expectations. This step is crucial to avoid any surprises down the line.

Regular Reviews and Updates: Insurance needs can change over time, so it’s important to regularly review and update your plan. Stay informed about any changes in your personal or business situation that could impact your insurance requirements. Great Western Insurance offers flexible plans that can be adjusted to accommodate these changes, ensuring your coverage remains up-to-date and relevant.

Conclusion: Your Path to a Secure Future

By following these five strategic steps, you’ve empowered yourself to create an ultimate Great Western Insurance plan that provides comprehensive coverage and peace of mind. From understanding your unique risks to customizing a plan that perfectly fits your needs, you’re now well-equipped to navigate the insurance landscape with confidence. Remember, insurance is an investment in your future, and with Great Western Insurance, you’ve chosen a trusted partner to guide you along the way. Stay informed, stay protected, and embrace a secure future with your tailored insurance plan.

🌟 Note: Regularly review your insurance needs and plan to ensure it continues to provide the coverage you require as your life and business evolve.

FAQ

What are the key benefits of Great Western Insurance plans?

+

Great Western Insurance offers a range of benefits, including comprehensive coverage options, customizable plans, and competitive pricing. Their plans are designed to provide peace of mind and financial protection for individuals and businesses.

How can I contact Great Western Insurance for further assistance?

+

You can reach out to Great Western Insurance through their official website, where you’ll find contact information and resources. Their team is dedicated to providing excellent customer service and will be happy to assist you with any queries.

Are there any discounts available for Great Western Insurance plans?

+

Yes, Great Western Insurance offers various discounts to their policyholders. These discounts may include multi-policy discounts, loyalty rewards, and even discounts for certain safety features or green initiatives. It’s worth exploring these options to maximize your savings.

Can I customize my Great Western Insurance plan over time?

+

Absolutely! Great Western Insurance understands that your needs may change over time. Their plans are designed to be flexible, allowing you to make adjustments and customize your coverage as your circumstances evolve. This ensures your insurance plan remains relevant and tailored to your needs.

What happens if I need to file a claim with Great Western Insurance?

+

In the event of a claim, Great Western Insurance has a dedicated claims team ready to assist you. They provide clear guidance and support throughout the claims process, ensuring a smooth and efficient resolution. Remember to keep your policy information handy and contact them promptly to initiate the process.