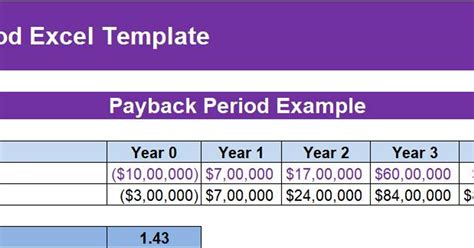

When it comes to financial analysis and decision-making, understanding the payback period of an investment is crucial. The payback period represents the time it takes for an investment to recover its initial cost. In this blog post, we will explore how to calculate and analyze payback periods using Microsoft Excel, empowering you to make informed financial choices.

Calculating Payback Period in Excel

Excel provides a straightforward way to determine the payback period of an investment. Here's a step-by-step guide to calculate the payback period:

-

Prepare your data: Create a table in Excel with the following columns:

- Time Period: Representing the time elapsed since the investment.

- Cash Flow: Showing the cash inflows and outflows for each period.

-

Input your investment data: Enter the initial investment amount and the expected cash flows for each time period.

-

Calculate the cumulative cash flow: In a new column, use the formula

=SUM(Cash Flow)to calculate the cumulative cash flow up to each time period. -

Determine the payback period: Identify the time period where the cumulative cash flow exceeds the initial investment. This time period represents the payback period.

For example, if your initial investment is $10,000 and the cumulative cash flow exceeds $10,000 in the 3rd time period, your payback period is 3 years.

Analyzing Payback Periods

Once you have calculated the payback period, it's essential to analyze and interpret the results. Here are some key considerations:

-

Short vs. Long Payback Periods: A shorter payback period indicates a quicker recovery of the initial investment, which is generally favorable. However, longer payback periods may be acceptable depending on the nature of the investment and your risk appetite.

-

Cash Flow Patterns: Analyze the cash flow pattern over time. Look for consistent positive cash flows, as they contribute to a shorter payback period. Negative cash flows or irregular patterns may impact the overall payback timeline.

-

Comparison with Industry Standards: Research and compare your calculated payback period with industry benchmarks. This comparison can help you assess the competitiveness and attractiveness of your investment.

-

Sensitivity Analysis: Perform sensitivity analysis to understand how changes in cash flows or investment amounts affect the payback period. This analysis helps identify the robustness of your investment decision.

Visualizing Payback Periods

To enhance your understanding and communication of payback periods, consider visualizing your data. Excel offers various charting options to present your findings effectively.

Line Chart

A line chart can visually represent the cumulative cash flow over time. This chart helps identify the point where the cumulative cash flow intersects with the initial investment, indicating the payback period.

Bar Chart

A bar chart can display the cash flows for each time period. This visualization makes it easier to compare the magnitudes of cash flows and understand their impact on the payback period.

Tips for Effective Payback Period Analysis

-

Accurate Data: Ensure the data you input is accurate and up-to-date. Inaccurate data can lead to misleading results.

-

Consistency in Time Periods: Maintain consistent time periods throughout your analysis. Irregular time intervals can complicate the calculation and interpretation.

-

Consider Discounted Cash Flow: If your investment spans multiple years, consider using discounted cash flow techniques to account for the time value of money.

-

Sensitivity Analysis: Perform sensitivity analysis to assess the impact of variations in cash flows or investment amounts on the payback period.

By following these tips and utilizing Excel's capabilities, you can make well-informed financial decisions and effectively communicate the payback periods of your investments.

Conclusion

Understanding and calculating payback periods is a vital aspect of financial analysis. Excel provides a user-friendly platform to determine payback periods, analyze cash flow patterns, and make informed investment choices. By visualizing your data and considering key factors, you can enhance your financial decision-making process and optimize your investment strategies.

FAQ

What is the formula for calculating payback period in Excel?

+

The formula for calculating payback period in Excel is: =MATCH(0,CUMIPMT(rate,nper,pv,0,type),0), where rate is the interest rate, nper is the number of periods, pv is the present value (initial investment), and type is the timing of the cash flows (0 for end of period, 1 for beginning of period). This formula returns the period number where the cumulative cash flow exceeds the initial investment.

How can I handle irregular cash flows in my payback period calculation?

+

To handle irregular cash flows, you can use the CUMIPMT function in Excel, which allows you to specify the cash flow amounts for each period. This function calculates the cumulative cash flow up to each time period, taking into account the irregular cash flows.

Can I perform sensitivity analysis for payback periods in Excel?

+

Yes, Excel provides various tools for sensitivity analysis. You can use data tables or the Goal Seek feature to analyze how changes in cash flows or investment amounts affect the payback period. This helps you understand the robustness of your investment decision and identify potential risks.

What are some alternative methods to calculate payback period?

+

Alternative methods include the discounted payback period, which considers the time value of money, and the modified internal rate of return (MIRR), which provides a comprehensive evaluation of investment returns. These methods offer different perspectives on investment analysis and can be calculated using Excel’s financial functions.