Calculating the Capital Asset Pricing Model (CAPM) alpha in Excel can be a useful tool for investors and analysts to assess the performance of an investment relative to its expected return. CAPM alpha represents the excess return of an asset compared to its predicted return based on the market risk premium and beta. In this step-by-step guide, we will walk you through the process of calculating CAPM alpha in Excel, providing you with the necessary tools to analyze investment performance.

Understanding CAPM Alpha

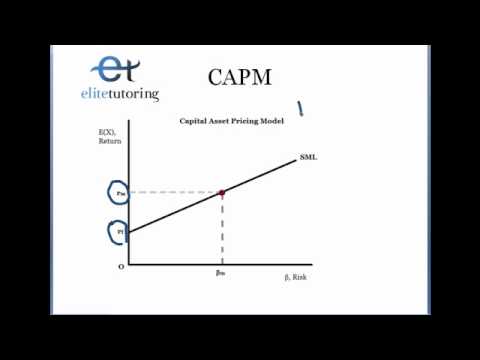

Before we dive into the calculation, let's briefly understand what CAPM alpha represents. CAPM is a model that helps determine the expected return of an asset based on its risk. Alpha, in this context, measures the excess return of an investment over its expected return, taking into account the market risk premium and the asset's beta.

A positive alpha indicates that the investment has outperformed its expected return, while a negative alpha suggests underperformance. By calculating CAPM alpha, investors can evaluate the efficiency of their investment strategies and make informed decisions.

Data Required for CAPM Alpha Calculation

To calculate CAPM alpha in Excel, you will need the following data points:

- Expected Return (re): The expected return on the investment, which can be estimated using CAPM.

- Actual Return (ra): The actual return achieved by the investment over a specific period.

- Risk-Free Rate (rf): The risk-free rate of return, often represented by the yield of government bonds.

- Market Risk Premium (rm - rf): The difference between the expected return of the market portfolio and the risk-free rate.

- Beta (β): A measure of the asset's volatility relative to the market. It represents the asset's sensitivity to market movements.

Step-by-Step Guide to Calculating CAPM Alpha in Excel

-

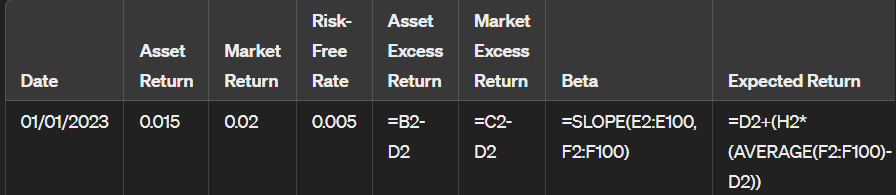

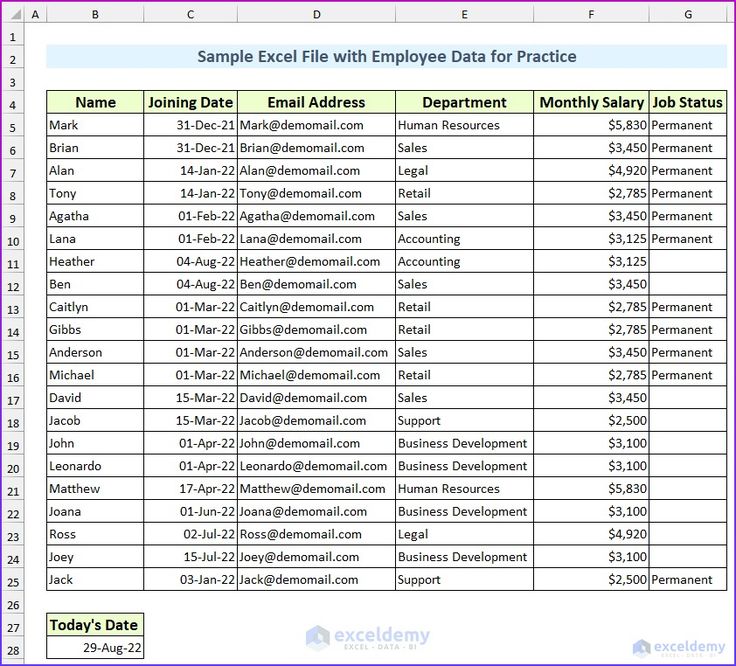

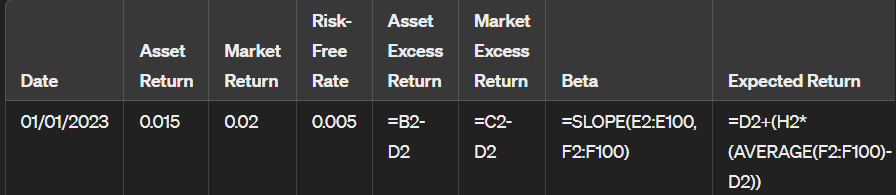

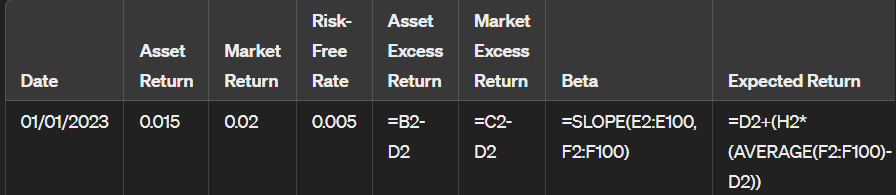

Enter Data in Excel

Open a new Excel workbook and create a sheet for your calculations. Input the necessary data into the spreadsheet. You should have columns for the expected return (re), actual return (ra), risk-free rate (rf), market risk premium (rm - rf), and beta (β). Ensure that the data is accurate and up-to-date.

-

Calculate CAPM Expected Return

To estimate the expected return (re) using CAPM, use the following formula in a new cell:

re = rf + β * (rm - rf)

Where:

- re is the expected return.

- rf is the risk-free rate.

- β is the beta of the asset.

- rm is the expected return of the market portfolio.

-

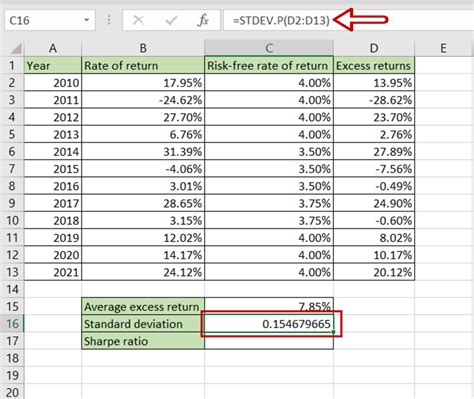

Calculate CAPM Alpha

Once you have the expected return, you can calculate CAPM alpha by subtracting the expected return from the actual return. Use the following formula in a new cell:

Alpha = ra - re

Where:

- Alpha is the CAPM alpha.

- ra is the actual return.

- re is the expected return calculated in step 2.

-

Interpret the Results

After calculating CAPM alpha, you can interpret the results as follows:

- A positive alpha indicates that the investment has outperformed its expected return based on market risk and beta.

- A negative alpha suggests that the investment has underperformed its expected return.

- An alpha close to zero implies that the investment's performance is in line with its expected return.

Example Calculation

Let's consider an example to illustrate the calculation of CAPM alpha in Excel. Suppose you have the following data for an investment:

| Expected Return (re) | Actual Return (ra) | Risk-Free Rate (rf) | Market Risk Premium (rm - rf) | Beta (β) |

|---|---|---|---|---|

| 8% | 12% | 3% | 7% | 1.5 |

-

Step 1: Enter Data

Input the above data into your Excel spreadsheet. Ensure that the expected return (re) is calculated using the CAPM formula.

-

Step 2: Calculate CAPM Expected Return

Use the CAPM formula to calculate the expected return (re):

re = 3% + 1.5 * (7%) = 12.5%

-

Step 3: Calculate CAPM Alpha

Subtract the expected return from the actual return to find the alpha:

Alpha = 12% - 12.5% = -0.5%

-

Step 4: Interpret the Results

In this example, the alpha is negative (-0.5%), indicating that the investment has underperformed its expected return. This means that the investment's performance was lower than what was predicted by the CAPM model.

Conclusion

Calculating CAPM alpha in Excel is a valuable technique for investors and analysts to assess the performance of their investments. By following the step-by-step guide provided in this blog post, you can easily calculate CAPM alpha and gain insights into the excess return of your investments. Remember to regularly update your data and perform sensitivity analysis to make informed investment decisions.

FAQ

What is CAPM alpha, and why is it important for investment analysis?

+

CAPM alpha represents the excess return of an investment over its expected return, taking into account market risk and beta. It is important for investment analysis as it helps investors evaluate the performance of their investments relative to the market and make informed decisions.

How often should I calculate CAPM alpha for my investments?

+

It is recommended to calculate CAPM alpha periodically, such as quarterly or annually, to monitor the performance of your investments over time. Regular calculation allows you to identify trends and make timely adjustments to your investment strategies.

Can CAPM alpha be used for short-term investment decisions?

+While CAPM alpha provides valuable insights into long-term investment performance, it may not be as reliable for short-term decisions. Short-term fluctuations in the market can impact alpha calculations, making it more suitable for evaluating long-term investment strategies.

What are some limitations of CAPM alpha calculations?

+CAPM alpha calculations rely on accurate estimates of expected returns, market risk, and beta. Inaccurate or outdated data can lead to misleading results. Additionally, CAPM alpha does not account for all factors that may influence investment performance, such as company-specific risks or market anomalies.