The payback period is a financial metric used to evaluate the time it takes for an investment to recover its initial cost. It provides insights into the liquidity and risk associated with a project or investment. In this blog post, we will guide you through the process of calculating the payback period in Excel, a widely used spreadsheet software, and explore its applications in financial analysis.

Understanding the Payback Period

The payback period is a straightforward concept that calculates the time required for the cumulative cash flows of an investment to equal the initial investment amount. It helps businesses and investors assess the potential return on their investments and make informed decisions regarding resource allocation.

By determining the payback period, analysts can identify projects with shorter recovery times, indicating quicker liquidity and potentially lower risk. It is a valuable tool for comparing investment options and prioritizing projects based on their financial viability.

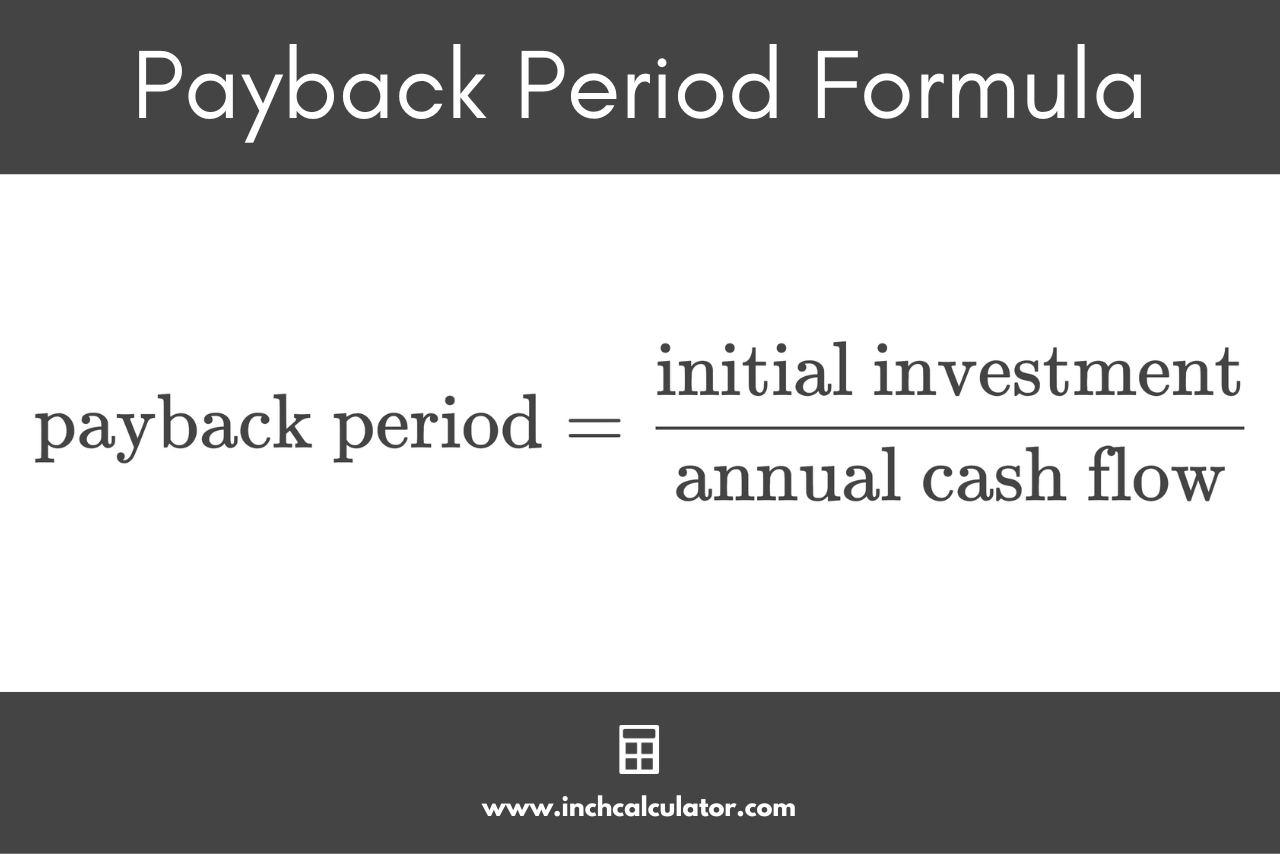

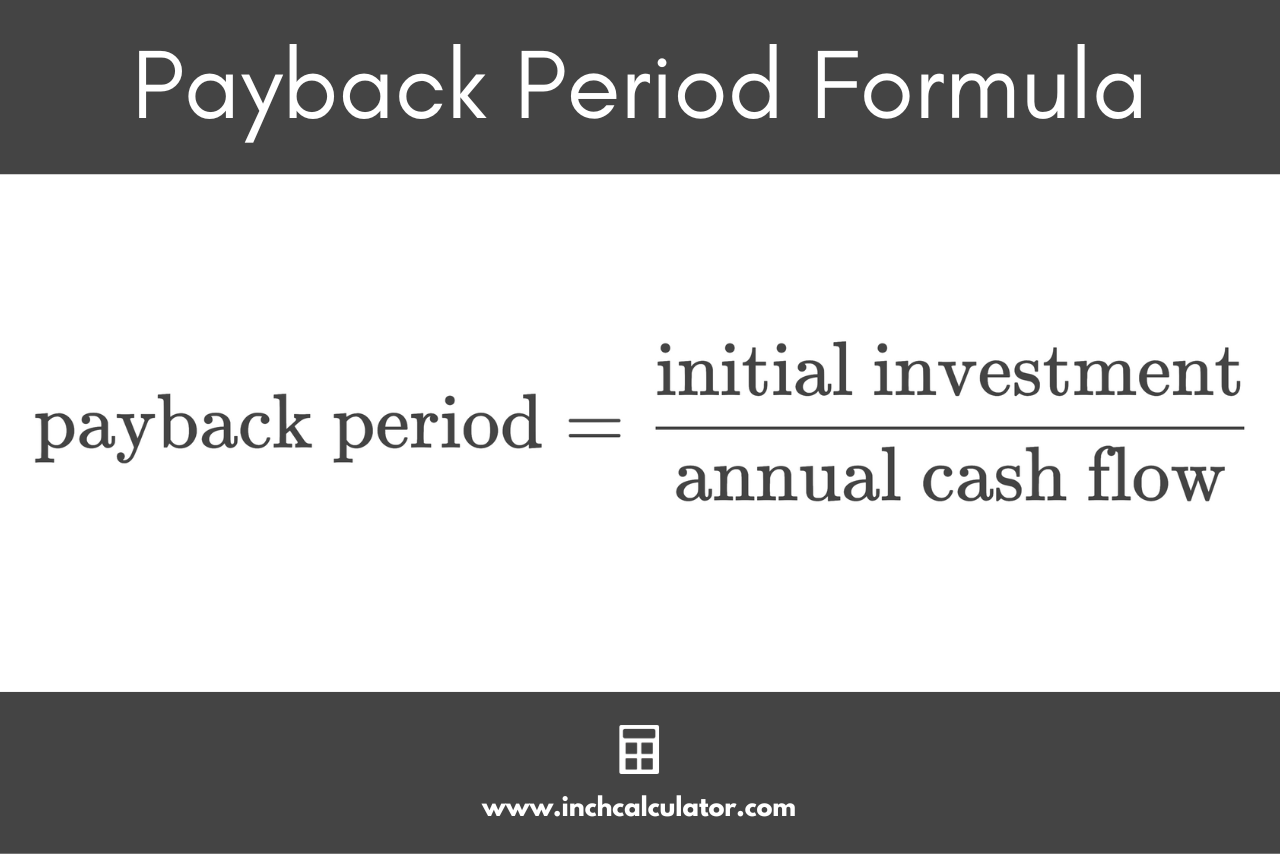

Formula for Calculating the Payback Period

The formula for calculating the payback period is relatively simple:

Payback Period = Initial Investment / Annual Cash Inflow

In this formula, the initial investment represents the total cost of the project or investment, while the annual cash inflow refers to the net cash generated by the project each year. By dividing the initial investment by the annual cash inflow, we can determine the number of years it takes to recover the initial investment.

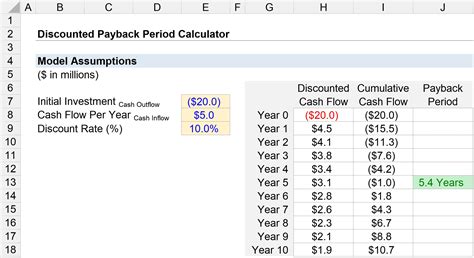

Step-by-Step Guide to Calculating the Payback Period in Excel

Now, let's delve into the practical steps to calculate the payback period using Excel. Follow these instructions to perform the calculation accurately:

Step 1: Gather Data

Begin by collecting the necessary data for your analysis. You will need the following information:

- Initial Investment: The total cost of the project or investment.

- Annual Cash Inflow: The net cash generated by the project each year.

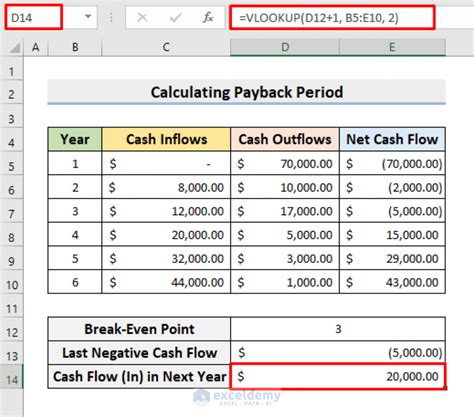

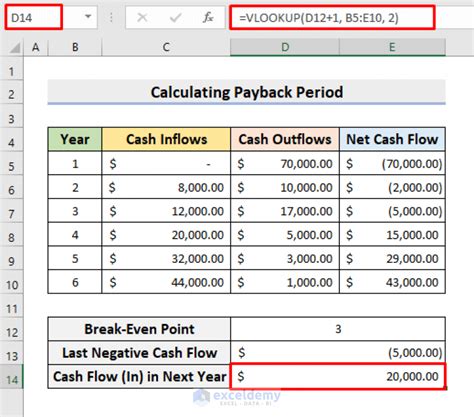

Step 2: Input Data into Excel

Open a new Excel workbook and create a new worksheet. In the first column, label the rows as follows:

- Initial Investment

- Annual Cash Inflow

In the adjacent cells, input the values for your initial investment and annual cash inflow. Ensure that you use consistent units of measurement (e.g., dollars) for both inputs.

Step 3: Calculate the Payback Period

In an empty cell, enter the formula for calculating the payback period:

=Initial Investment / Annual Cash Inflow

Excel will automatically perform the calculation and display the result as a decimal value. To convert it into years, multiply the decimal value by 12 (assuming a 12-month year):

= Payback Period * 12

Step 4: Interpret the Results

The calculated payback period represents the number of years it takes for the investment to recover its initial cost. A shorter payback period indicates quicker liquidity and potentially lower risk, making it an attractive investment option.

Keep in mind that the payback period does not consider the time value of money or the potential for cash flows beyond the initial investment recovery. Therefore, it is essential to complement the payback period analysis with other financial metrics for a comprehensive evaluation.

Applications of the Payback Period

The payback period has several practical applications in financial analysis and decision-making:

Project Evaluation

The payback period is widely used to evaluate the financial viability of projects. By comparing the payback periods of different projects, businesses can prioritize investments with shorter recovery times, ensuring efficient resource allocation.

Risk Assessment

A shorter payback period indicates lower risk as the investment recovers its initial cost more quickly. This is particularly useful for risk-averse investors or businesses operating in volatile markets.

Investment Comparison

The payback period allows for a quick comparison of investment options. By analyzing the payback periods of various investments, analysts can identify those with faster liquidity and make informed decisions based on their risk appetite and financial goals.

Limitations of the Payback Period

While the payback period is a valuable tool, it has certain limitations that should be considered:

Ignores Time Value of Money

The payback period does not account for the time value of money, which means it does not consider the potential for future cash flows or the opportunity cost of delaying other investments.

Does Not Reflect Profitability

The payback period solely focuses on the recovery of the initial investment and does not provide insights into the profitability or return on investment. It is essential to complement the payback period analysis with other financial metrics, such as internal rate of return (IRR) or net present value (NPV), to gain a comprehensive understanding of an investment's potential.

Assumes Constant Cash Flows

The payback period assumes that cash flows are constant throughout the investment period. In reality, cash flows may vary, and projects with irregular cash flows may be misrepresented by the payback period calculation.

Best Practices for Using the Payback Period

To maximize the effectiveness of the payback period analysis, consider the following best practices:

- Use the payback period as a preliminary screening tool to identify projects with shorter recovery times.

- Combine the payback period with other financial metrics, such as IRR or NPV, for a more comprehensive evaluation.

- Consider the limitations of the payback period and interpret the results in conjunction with other financial analyses.

- Adjust the payback period calculation to account for irregular cash flows if necessary.

Conclusion

The payback period is a straightforward yet powerful tool for financial analysis, providing insights into the liquidity and risk associated with investments. By following the step-by-step guide outlined in this blog post, you can calculate the payback period in Excel and make informed decisions regarding project evaluation and resource allocation. Remember to consider the limitations and best practices associated with the payback period to ensure a comprehensive financial analysis.

FAQ

What is the significance of the payback period in financial analysis?

+The payback period helps assess the liquidity and risk of an investment by determining the time required to recover the initial investment. It is a valuable tool for project evaluation and resource allocation.

Can the payback period be used for long-term investments?

+While the payback period provides insights into short-term liquidity, it may not be suitable for long-term investments as it does not consider the time value of money or potential future cash flows.

How does the payback period compare to other financial metrics like IRR or NPV?

+The payback period is a simpler metric compared to IRR or NPV, focusing solely on initial investment recovery. It is best used as a preliminary screening tool, while IRR and NPV provide more comprehensive evaluations of an investment’s profitability.