Creating an effective investment strategy is crucial for long-term financial success. The Safal Niveshak approach offers a systematic and disciplined method to build a profitable portfolio. In this blog post, we will explore the five essential steps to develop your ultimate Safal Niveshak strategy and navigate the investment landscape with confidence.

1. Define Your Investment Goals and Risk Tolerance

Before diving into the world of investing, it's vital to have a clear understanding of your financial objectives and risk appetite. Ask yourself the following questions:

- What are your short-term and long-term financial goals? (e.g., buying a house, funding education, retirement planning)

- How comfortable are you with market volatility and potential losses? (conservative, moderate, aggressive)

- Do you prefer a more hands-on approach or would you rather delegate investment decisions to professionals?

By defining your investment goals and risk tolerance, you can tailor your strategy to align with your financial aspirations and personal comfort level.

2. Educate Yourself About the Market and Investment Options

Gaining knowledge about the stock market and various investment options is crucial for making informed decisions. Consider the following steps to educate yourself:

- Read books, articles, and blogs written by experienced investors and financial experts.

- Follow reputable financial websites and news sources to stay updated on market trends and news.

- Attend investment seminars, webinars, or workshops to learn from industry professionals.

- Explore online courses or enroll in formal education programs focused on finance and investing.

By investing time in education, you'll develop a solid foundation of knowledge to make well-informed investment choices.

3. Develop a Diversified Portfolio

Diversification is a key principle of the Safal Niveshak strategy. It involves spreading your investments across different asset classes, sectors, and geographical regions to mitigate risk. Here's how you can build a diversified portfolio:

- Allocate your investments across stocks, bonds, real estate, and other asset classes based on your risk tolerance and financial goals.

- Within each asset class, consider diversifying further by investing in various sectors or industries.

- Explore international markets to diversify your portfolio geographically.

- Consider mutual funds or exchange-traded funds (ETFs) as a convenient way to achieve diversification.

By diversifying your portfolio, you reduce the impact of any single investment's performance on your overall returns.

4. Conduct Thorough Research and Analysis

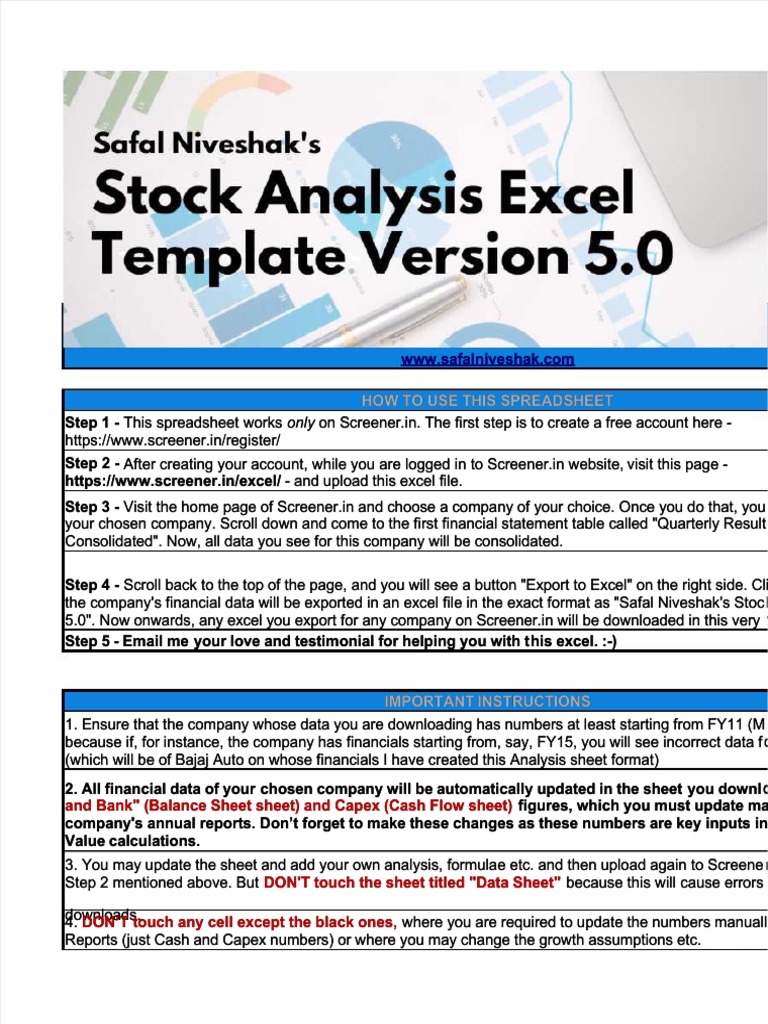

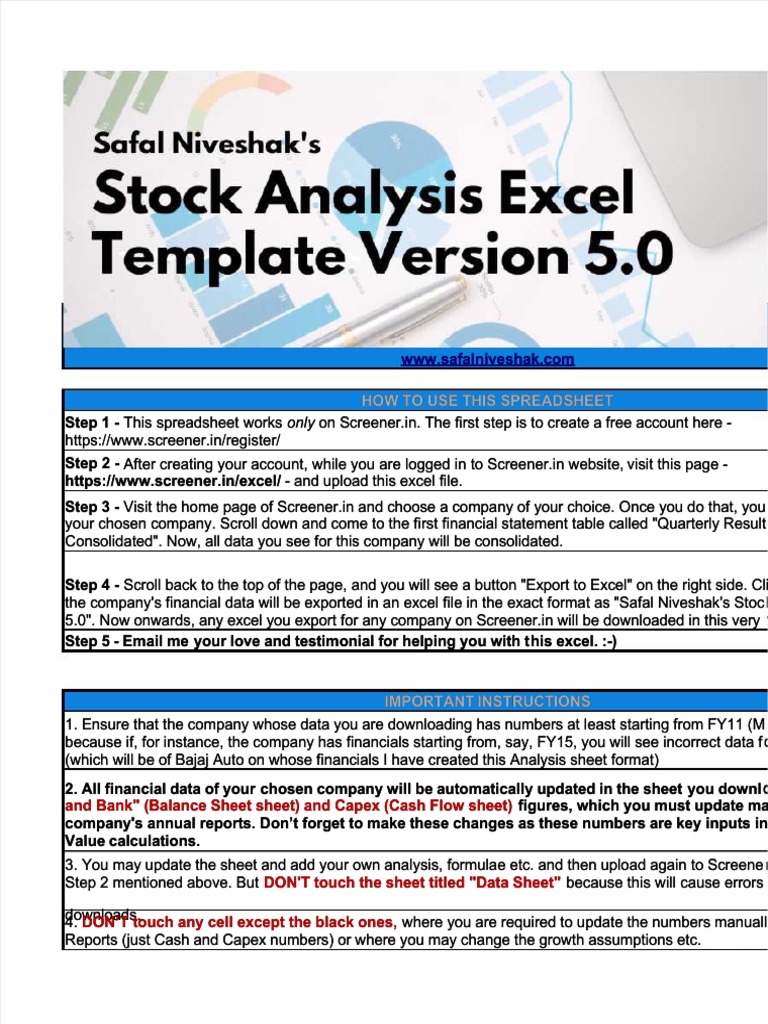

Conducting research and analysis is a critical aspect of the Safal Niveshak strategy. It involves evaluating potential investment opportunities and making informed decisions. Here's a step-by-step guide:

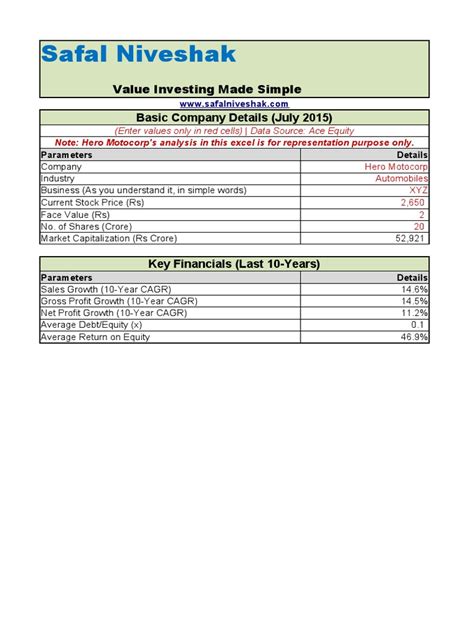

- Identify Potential Investments: Look for companies or assets that align with your investment goals and have strong fundamentals.

- Fundamental Analysis:

- Study the company's financial statements, including income statements, balance sheets, and cash flow statements.

- Analyze key financial ratios such as price-to-earnings (P/E), debt-to-equity, and return on equity.

- Assess the company's competitive advantages, management team, and industry position.

- Technical Analysis:

- Study price charts and use technical indicators to identify trends, support, and resistance levels.

- Analyze historical price patterns and volume to make informed trading decisions.

- Risk Assessment: Evaluate the potential risks associated with the investment, such as market risk, industry-specific risks, and company-specific risks.

- Set Investment Criteria: Establish clear criteria for selecting investments, such as valuation thresholds, growth potential, and risk tolerance.

Thorough research and analysis will help you make informed investment decisions and reduce the likelihood of making impulsive choices.

5. Implement a Disciplined Investment Approach

Discipline is a cornerstone of the Safal Niveshak strategy. It involves sticking to your investment plan, even in the face of market volatility and emotional temptations. Here's how you can implement a disciplined approach:

- Create an Investment Plan: Develop a written plan that outlines your investment goals, asset allocation, and investment criteria.

- Set Stop-Loss Orders: Determine your risk tolerance and set stop-loss orders to limit potential losses.

- Practice Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions, to take advantage of average purchase prices.

- Avoid Emotional Decisions: Stay focused on your investment plan and avoid making impulsive decisions based on short-term market fluctuations.

- Regularly Review and Rebalance: Periodically review your portfolio and rebalance it to maintain your desired asset allocation.

By implementing a disciplined investment approach, you can navigate market ups and downs with confidence and stay true to your long-term investment strategy.

Conclusion

Developing an ultimate Safal Niveshak strategy involves a combination of goal-setting, education, diversification, research, and discipline. By following these five steps, you can create a well-rounded investment plan that aligns with your financial objectives and risk tolerance. Remember, investing is a journey, and with a systematic approach, you can achieve long-term success and build a profitable portfolio.

FAQ

What is the Safal Niveshak strategy?

+

The Safal Niveshak strategy is a systematic and disciplined approach to investing that emphasizes long-term financial success. It focuses on fundamental analysis, diversification, and a well-defined investment plan.

How do I start investing using the Safal Niveshak strategy?

+

To get started, define your investment goals and risk tolerance, educate yourself about the market, build a diversified portfolio, conduct thorough research, and implement a disciplined investment approach.

Is diversification necessary for the Safal Niveshak strategy?

+

Yes, diversification is a key principle of the Safal Niveshak strategy. It helps mitigate risk by spreading investments across different asset classes, sectors, and geographical regions.

How often should I review and rebalance my portfolio?

+

It’s recommended to review your portfolio periodically, such as annually or whenever there are significant changes in your financial situation or market conditions. Rebalancing helps maintain your desired asset allocation.