In the world of finance and investing, publicly owned companies are a fascinating subject, offering a glimpse into the inner workings of some of the most influential and powerful organizations. These companies, with their shares traded on stock exchanges, provide an opportunity for investors to become part-owners and share in their success. However, navigating the complex landscape of publicly owned companies can be daunting for many. In this comprehensive guide, we will delve into the secrets of these corporations, uncovering the key aspects that can help you make informed investment decisions.

Understanding Publicly Owned Companies

Publicly owned companies, also known as publicly traded companies, are businesses whose ownership is dispersed among a large number of shareholders. These shareholders can include individual investors, institutional investors like mutual funds or pension funds, and even other companies. By offering their shares to the public, these companies gain access to a vast pool of capital, which can be used for expansion, research and development, or other strategic initiatives.

The concept of publicly owned companies is rooted in the idea of democratizing ownership and allowing individuals to participate in the growth and profits of large enterprises. It provides a way for people to invest their money and potentially earn returns through dividends or capital gains when the company's stock price increases.

Key Secrets to Unlocking Success

1. Financial Health and Stability

When investing in publicly owned companies, one of the most critical aspects to consider is their financial health. A company's financial stability is a strong indicator of its ability to weather economic storms and deliver consistent returns. Here are some key financial metrics to analyze:

- Revenue Growth: Look for companies with consistent and sustainable revenue growth over time. A steady increase in revenue suggests a healthy and expanding business.

- Profitability: Examine the company's profit margins and return on investment (ROI). High profitability indicates efficient operations and the potential for future growth.

- Debt Management: Assess the company's debt levels and their ability to manage it effectively. High debt can be a red flag, especially if it outweighs the company's assets.

- Cash Flow: Positive cash flow is crucial for a company's long-term survival. Analyze the company's cash flow statements to ensure they have sufficient liquidity to fund operations and investments.

2. Competitive Advantage and Market Position

Understanding a company's competitive advantage and market position is essential for evaluating its long-term prospects. Here's what to consider:

- Unique Selling Proposition (USP): Identify what sets the company apart from its competitors. Does it have a unique product, service, or business model that gives it an edge in the market?

- Market Share: Assess the company's market share within its industry. A dominant market position can provide a strong foundation for future growth.

- Industry Trends: Stay updated on industry trends and analyze how the company is positioned to adapt and thrive in a changing market landscape.

- Barriers to Entry: Look for companies with high barriers to entry, making it difficult for new competitors to enter the market and disrupt their business.

3. Management and Leadership

The quality of a company's management team can greatly impact its success. Consider the following when evaluating management:

- Experience and Track Record: Research the background and accomplishments of the company's leadership. Look for a team with a proven track record of success and relevant industry experience.

- Strategic Vision: Assess the management's ability to develop and execute a clear and compelling strategic vision for the company's future.

- Communication and Transparency: Evaluate how transparent the company is with its shareholders and the public. Regular and honest communication is a sign of a trustworthy management team.

- Compensation Structure: Examine the compensation packages of the management team. Alignment between their incentives and the company's long-term goals is crucial.

4. Dividend Policy and Shareholder Returns

Dividends are a significant factor for many investors when considering publicly owned companies. Here's what you should know:

- Dividend History: Look for companies with a consistent dividend payment history. A stable dividend policy is a sign of financial stability and commitment to shareholders.

- Dividend Yield: Calculate the dividend yield, which is the annual dividend payment divided by the current stock price. A higher dividend yield can be attractive, but ensure it is sustainable.

- Dividend Growth: Companies that consistently increase their dividends over time are often seen as strong investment prospects.

- Alternative Shareholder Returns: Consider companies that offer alternative forms of shareholder returns, such as share buybacks or special dividends, which can boost stock prices.

5. Risk Assessment and Diversification

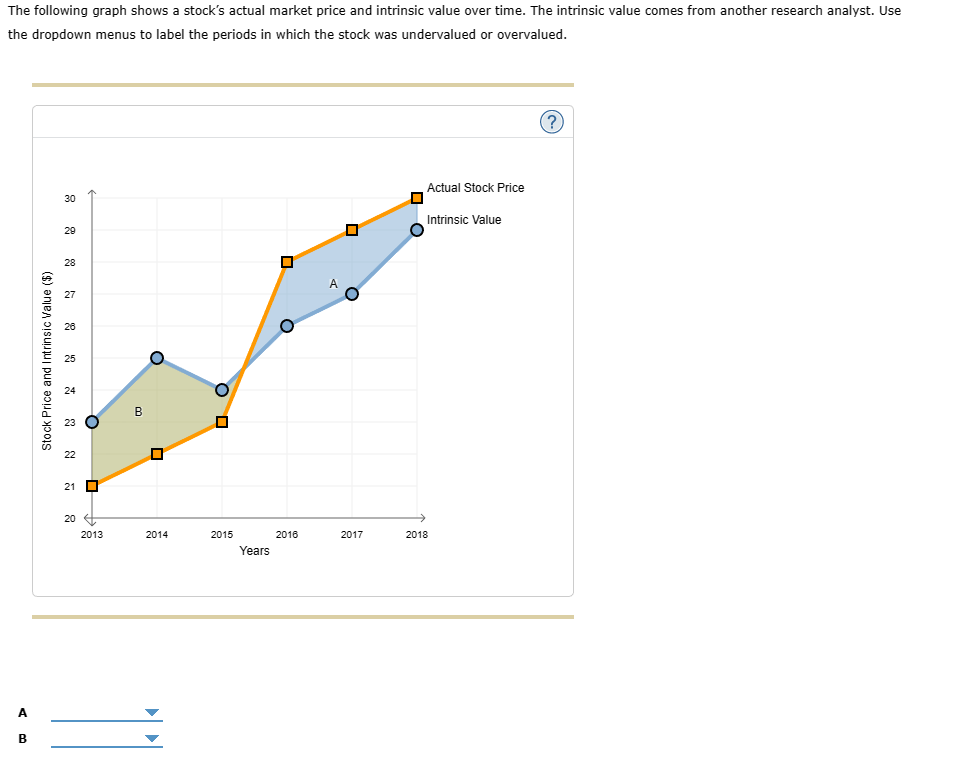

Investing in publicly owned companies carries risks, and it's essential to assess and manage these risks effectively. Here are some strategies to consider:

- Risk Assessment: Analyze the company's exposure to various risks, such as economic downturns, regulatory changes, or industry-specific challenges. Diversify your portfolio to mitigate these risks.

- Diversification: Diversify your investments across different sectors and industries to spread out risk. A well-diversified portfolio can help protect against the underperformance of any single company.

- Stop-Loss Orders: Implement stop-loss orders to automatically sell a stock if it falls below a certain price, helping to limit potential losses.

Unveiling the Power of Public Ownership

Publicly owned companies offer a unique opportunity for investors to participate in the growth and success of some of the world's largest and most influential enterprises. By understanding the secrets of these companies, from their financial health to their competitive advantages and management quality, investors can make more informed decisions. Remember, investing is a long-term game, and a well-researched and diversified portfolio can lead to substantial rewards over time.

💡 Note: Always conduct thorough research and seek professional advice before making any investment decisions. The stock market carries inherent risks, and past performance is not indicative of future results.

FAQ

What are the benefits of investing in publicly owned companies?

+

Investing in publicly owned companies offers benefits such as liquidity, transparency, and the potential for capital appreciation and dividend income. It allows individuals to participate in the growth of large enterprises and potentially earn returns.

How can I assess a company’s financial health?

+

To assess a company’s financial health, analyze its financial statements, including revenue growth, profitability, debt levels, and cash flow. Look for consistent and sustainable financial performance over time.

What are some key indicators of a company’s competitive advantage?

+

A company’s competitive advantage can be indicated by its unique selling proposition, market share, and ability to adapt to industry trends. Look for companies with strong barriers to entry and a sustainable market position.

How important is management quality in publicly owned companies?

+

Management quality is crucial as it directly impacts a company’s performance and future prospects. Look for experienced and competent leaders with a proven track record and a clear strategic vision for the company’s growth.

What should I consider when assessing a company’s dividend policy?

+

When assessing a company’s dividend policy, consider its dividend history, dividend yield, and dividend growth. A consistent and sustainable dividend policy can be a sign of financial stability and shareholder value.